- #Independent contractor expenses turbotax how to#

- #Independent contractor expenses turbotax download#

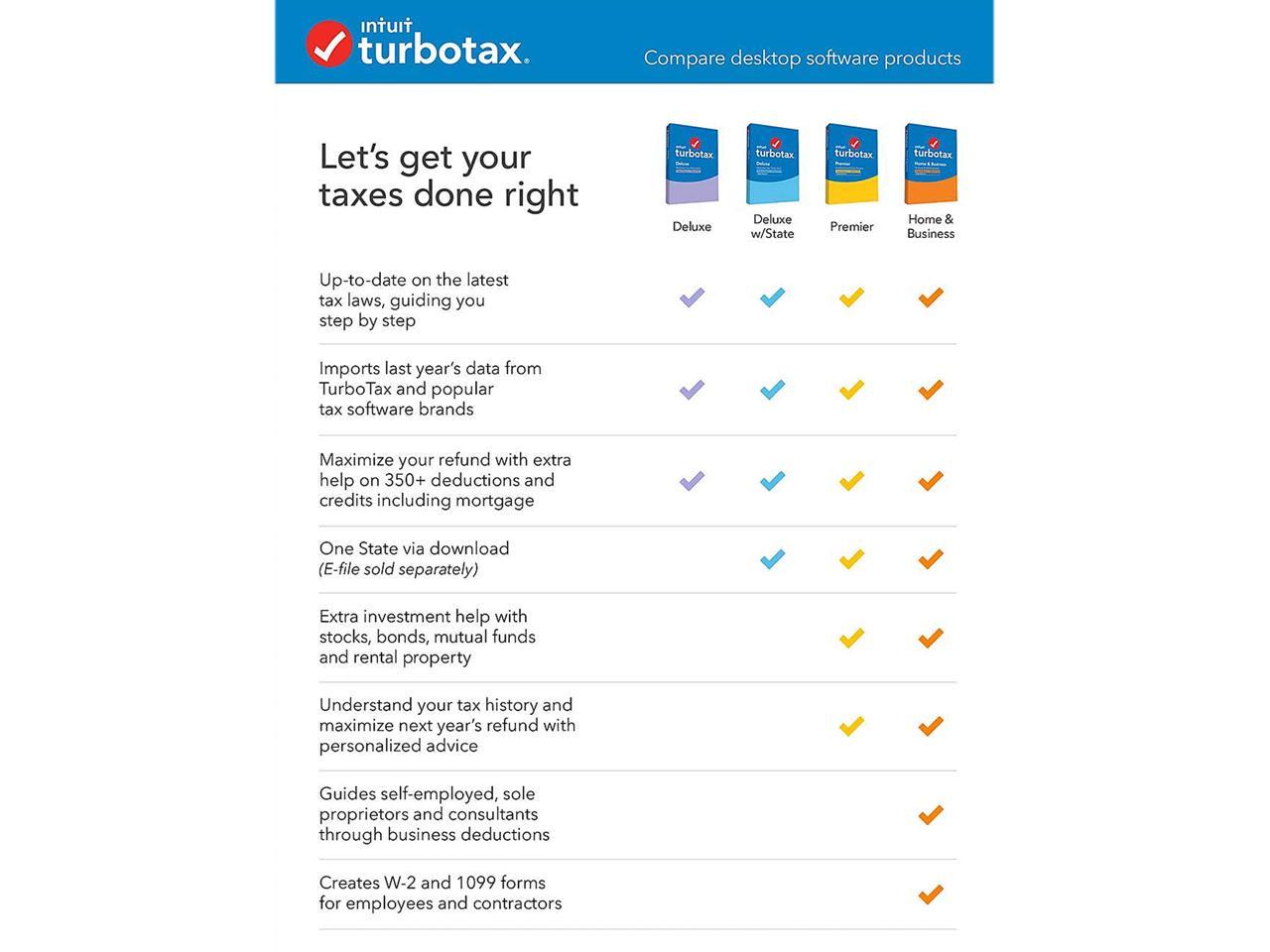

That’s not to say you should pay for features you don’t need, but just make sure your bases are covered. In other words, now’s not the time to get stingy: You want to get your taxes done, but also done right. The program you choose should be robust enough to handle complicated tax situations and sniff out tons of possible deductions, and also willing to promise a high-ish level of protection in case you’re audited.

#Independent contractor expenses turbotax how to#

How to balance your side hustle with a full-time jobĪlso, keep in mind that the cheapest tax software option isn’t necessarily the best tax software option. You may also receive a Form 1099-K (Opens in a new tab) from a third-party payment network like Venmo or PayPal if your client(s) paid you at least $600 that way. The tax software you use will definitely need to support that paperwork along with Form 1099-NEC (Opens in a new tab), the non-employee income document you get from your clients instead of a W-2. "Freelancer" is synonymous with "self-employed business owner" in the eyes of the IRS (more specifically " sole proprietor (Opens in a new tab)"), so you'll be reporting your business income and expenses on a Schedule C (Opens in a new tab) and your self-employment tax on a Schedule SE (Opens in a new tab) include both with your Form 1040 (Opens in a new tab), the standard individual tax filing form. What should you look for in a tax software program? Or, even better, some tax preparation tools are available completely online or via mobile app for maximum convenience.

#Independent contractor expenses turbotax download#

(How retro.) Nowadays, you can just download a program from a trusted tax prep company’s website. Essentially, it’s software that makes it less taxing to do your own taxes.īack in the day, tax software came in the form of a CD-ROM that could be downloaded to your desktop computer. Tax software is a type of software program that’s designed to guide users through the process of preparing and filing their returns, helping them comply with tax laws while identifying any deductions and credits that may be available. On the other hand, you could always go to a CPA and have them take care of your income tax return for you, but their fees could burn a hole in your pocket, too.įor a happy medium between the two, consider picking up some tax software. If you try to figure it all out on your own, you could still be hit with costly penalties and interest if you make a mistake.

However, simply filing your taxes is not enough. Since tax evasion is sort of a felony, filing your return every year is in your best interest. It’s an obnoxious, tedious ordeal - so obnoxious and tedious, in fact, that more than a third of freelancers don’t even bother paying taxes, according to the same poll. If your head isn’t already swirling from all that tax talk, consider the fact that a QuickBooks survey (Opens in a new tab) of 500 freelancers found that doing one’s taxes is among the most difficult challenges facing modern self-employed workers. Sure, it goes toward Social Security and Medicare which is cool for Future You - probably maybe? (Opens in a new tab) - but not so fun for Current You. Oh, and don’t forget about the whopping 15.3% federal self-employment tax (Opens in a new tab) you’re required to pay if you earned at least $400 (Opens in a new tab) from your freelance work. How to know when to make a side hustle a main gig (You might even be penalized (Opens in a new tab) if you neglected to pay them altogether.) Perhaps most frustratingly, instead of getting a tax refund like the 9-to-5 crowd, you may actually need to cough up extra money to cover the year's taxes in case those estimated payments were lower than needed. You’re also responsible for making and keeping track of estimated tax payments (Opens in a new tab) each quarter, since the money isn't automatically deducted from your paychecks throughout the year. For one thing, you need to maintain year-round business records that are separate from your personal ones to make sure you’re organized once tax season rolls around. When you boil it down, being your own boss is really hard work - and no time is that more apparent than during tax season.Ĭompared to those with a typical 9-to-5 job, freelancers, independent contractors, and other self-employed workers face a unique set of challenges when it comes to filing an annual return. But most of the time, it’s cabin fever, caffeine withdrawal, fickle cash flows, and fierce competition for clients. TurboTax Premier 2022 Fed & State (Amazon Exclusive) (Opens in a new window)įreelancing isn’t all sweatpants and snooze buttons.H&R Block 2023 (2022 Tax Year) (Opens in a new window).Intuit TurboTax (Opens in a new window).

0 kommentar(er)

0 kommentar(er)